Understanding the power of credit means knowing about your credit score and credit report.

Your credit score is an important record of your personal finance journey. While some think having bad credit at some point is a part of growing up, you can avoid it by learning good credit habits early on.

anchor

Introduction to credit scores

Here we’ll cover the basics of credit scores and credit reports, what they are, why they are important, what is considered a good credit score, and some tips on how to maintain or improve your credit score.

View this as your go-to guide for learning the ins and outs of credit scores and credit reports.

While each section of this guide can be read by itself, to get the most of it, read it all the way through at least once, then use it as a reference tool.

Interested in a specific topic? You can easily navigate to specific sections using the provided links.

anchor

What is a credit score?

Your credit score is a grade of your financial health at a point in time. Your credit score is determined based on a scorecard of your credit history, called your credit report. Think of your credit report as the report card of your financial health. It is the scorecard that major financial institutions use to decide if you’re likely to repay a loan that they might make to you.

If your credit report is a report card of your credit history, your credit score is your grade at a point in time. Your credit score is a 3 digit number, generally between 300 and 850, which gives lenders a numeric summary of your creditworthiness. Credit scores are calculated using a credit scoring model, which is why different lenders or credit bureaus might give you a different score even if they’re looking at the same data

Credit scores typically fall into the following ranges:

What are the different credit scoring models?

The two main credit scoring models are FICO and VantageScore. These two models use different software and algorithms to calculate credit scores based on the consumer credit data found in a credit report.

While your credit score using the two different models will generally not be the exact same 3-digit number, the results should be similar. Below we’ve highlighted some specifics about the two different types of scoring models.

- FICO: The FICO scoring model is considered the most widely-used scoring model and resulting credit score. The FICO scoring model creates different models for each of the three credit bureaus. To obtain a FICO score, you must have at least 6 months of credit activity.

- VantageScore: Different from the FICO scoring model, VantageScore uses one model that can be used equally across all three credit bureaus, rather than a different model for each bureau. To obtain a score from VantageScore, you must have at least 1 account in your credit report. This account does not need to have existed for a specific period of time.

What is a credit bureau?

A credit bureau is a company that collects consumer credit data from creditors and lenders, which is then reported in the form of a credit report. The information provided by a credit bureau in the form of a credit report is then input into one of the credit scoring models to arrive at a credit score.

There are three main credit bureaus: Experian, Equifax, and TransUnion. Each of the credit bureaus receives information and data from lenders about consumers credit behaviors. The credit bureaus use this data to determine a credit score. The credit score reported by each of the credit bureaus may differ because different scoring models are used. Not all lenders or creditors share information with all three credit bureaus, so you may find slight differences in your credit score as reported by each of the bureaus.

How can you find your credit score?

There are various places where you can get a copy of or track your credit score. We’ll keep it easy with these options:

- Check your credit card company. They often offer free credit score monitoring and credit report options to cardholders. Different companies offer access to credit scores from different bureaus.

- Look for free credit monitoring apps online. If you don’t have a credit card yet, then you can use these apps to track your credit score. Some free monitoring tools offer scores across credit bureaus.

- Check with the credit bureaus. You can receive your credit report from each of the credit bureaus, once per year for free. Remember, not all lenders or creditors share information with all three credit bureaus and the credit bureaus use different scoring models, so you may notice small differences in your credit score between each of the bureaus.

Remember, checking or monitoring your credit score should not negatively impact your credit score. By monitoring your credit score through one of the above options, you are not performing a hard inquiry, so no need to worry that checking in on how your credit score is doing will bring down your score.

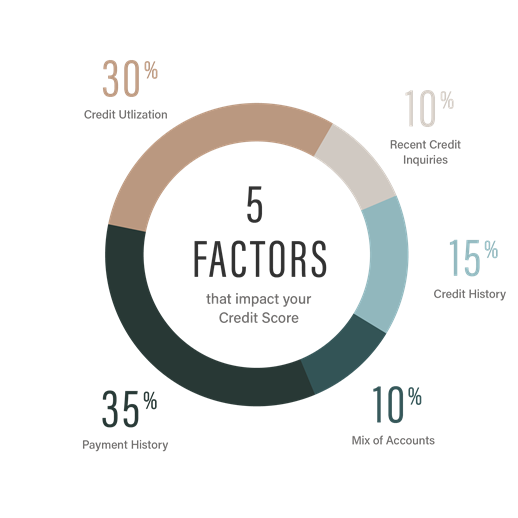

What factors impact a credit score?

Credit scores are impacted by a variety of factors, and these factors can cause the score to go up or go down. The main factors impacting your score are the following:

-

Payment history

Payment history is a record of the payments you have made to lenders over time. Consistent and timely payments on your credit cards, student loans, and any other outstanding debt contribute the greatest to your payment history and the health of your credit. The longer your timely payment history, the better for your credit score. No late payments!

-

Credit utilization

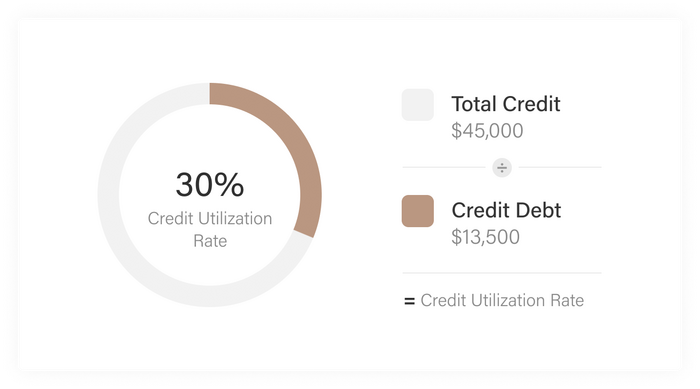

Credit utilization is the measure of how much of your total available credit you are using. “Total credit” refers to the amount of revolving credit you have available at your disposal.

How is credit utilization calculated? For example, if you have 3 credit cards, and those credit cards have credit limits of $10,000, $15,000, and $20,000, respectively, your total available credit would be $45,000. Credit utilization is expressed as a percentage, and a general guideline is that your utilization should be no more than 30%. This would mean that in our example, you are using less than $13,500 of the $45,000 of credit you have at your disposal. The lower your utilization percentage, the better for your credit score.

-

Credit history

Credit history is the record of all of the interactions you have had with lenders over time and how you paid back those borrowings. The longer your credit history, the better. While it may be tempting to close old credit card accounts or credit cards you no longer use, if it’s an old credit card account with no annual fee, it could be more advantageous to keep this account open. Older credit card accounts show that you have a longer credit history which is beneficial to your credit score.

-

Recent credit inquiries

Frequent hard inquiries can negatively impact your credit score by a few points. But, what’s a hard inquiry? A hard inquiry occurs when you apply for a new form of credit (such as a loan or credit card), and the person or company you are borrowing from formally requests (or “inquires”) about your credit history. Companies inquire about your credit history to better understand how well you’ve paid back previous loans and use this information to decide how much they are willing to loan to you and at what interest rate.

Having multiple hard inquiries in a short period of time can be an indicator of concern for a lender.

How does a hard inquiry differ from a soft inquiry? A soft inquiry generally will not impact your credit score and is typically the result of you looking up your own credit score or a company looking up your score to pre-approve you for a particular offer. In these circumstances, your credit score is not being pulled in reference to a specific loan application, and therefore the purpose is strictly informational. Therefore, these informational pulls do not impact your credit score in the same way hard inquiries impact your score.

-

Mix of accounts

The different types of credit you have at your disposal is your credit mix. A healthy credit mix is one with a variety of different accounts that include both installment debt, such as your car loans, mortgage, or student loans, as well as revolving debt like your credit card.

Why is a credit score important?

Your credit score determines your ability to enter into certain types of loan transactions and the interest rate on the loan. A higher credit score allows for greater lending opportunities at lower interest rates. When taking out a loan, such as a student loan, automobile loan, or mortgage, sufficient credit history and a good credit score are often necessary.

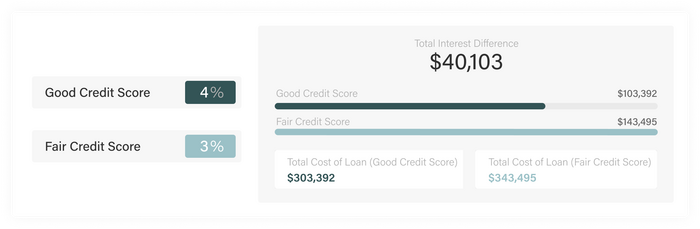

The difference between a good and fair credit score when applying for a loan could mean a difference of one or two percentage points of the interest rate. If one or two percentage points doesn’t sound like a lot, let’s look at an example.

As part of purchasing your dream home, you decide to take on a mortgage with the following information:

- Mortgage Price = $200,000

- Loan type = 30 years, fixed

- Interest rate = 3%

Over the life of the loan, with your good credit score and an interest rate of 3%, you will pay about $103,392 in interest. If in this same example, you had a fair credit score, which caused your interest rate to be 4%, you would pay $143,495 in interest over the life of the loan. That is a difference of $40,103 in interest over the life of the loan, all due to a change of one percent in the interest rate.

anchor

What is a credit report?

Your credit report details the history of your interactions with lenders. For example, the history included can be as recent as the car loan you took out three years ago, or as far back as the credit card you opened 10 years ago. Similar to your report card from school which showed your scores in a variety of classes, your credit report shows how timely you’ve been on your various loan payments, what types of credit you have open, and how long you’ve had a credit history.

Credit reports are generated by each of the three credit bureaus, Experian, Equifax, and TransUnion. Creditors and lenders report credit information and data to the bureaus, and this information is reported in a credit report.

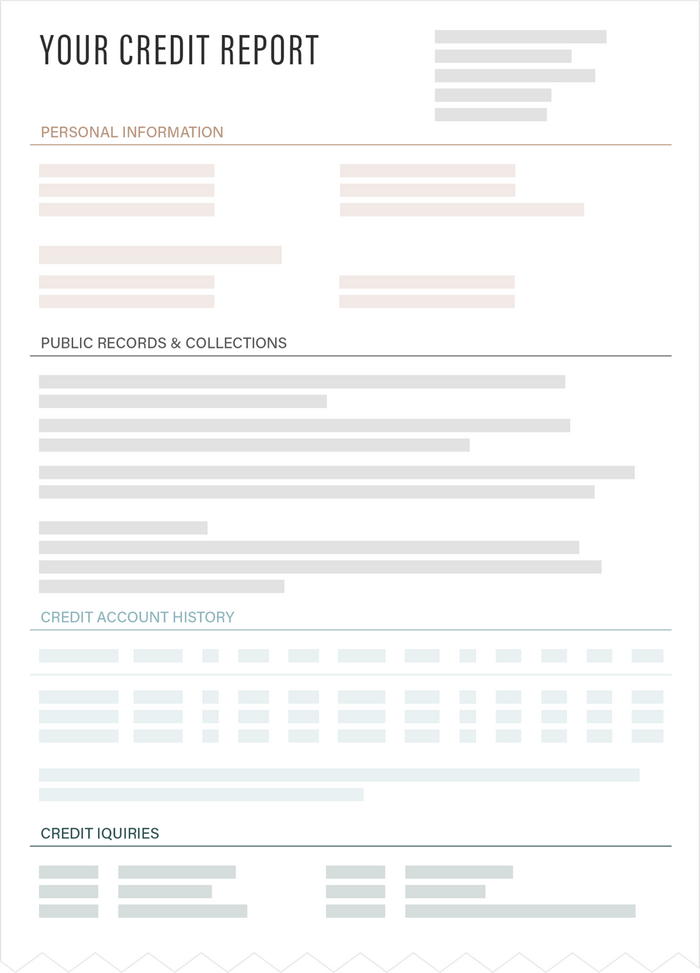

What information is included in a credit report?

A credit report includes four main categories of information:

- Personal Information

- Credit Account History

- Credit Inquiries

- Public Records & Collections

Below we’ve outlined the information you may find in each of the four categories when reviewing a credit report.

1. Personal Information

The personal information included in your credit report details all personally identifiable information about you that has been reported by creditors, lenders, and any other sources that submit information about you to the credit bureaus. Each of these sources may report your information to the bureaus differently, so this section may include all variations found for your personal information.

Within this section, you can expect to see all variations of the following information:

- Names

- Addresses

- Social security number

- Year of birth

- Telephone numbers

- Former or current employers

Remember, it’s important to review your personal information for accuracy! Your credit report should only report personally identifiable information about you. If you see an address reported that you’ve never lived at, or a phone number that doesn’t belong to you, take note of these items. All disputes of information should be reported to ensure accuracy of your report.

2. Credit Account History

Information included in the credit account history section of your credit report details each of the accounts you’ve had with a lender. This information is reported to the credit bureaus by each of your lenders and includes account types such as credit cards, mortgages, student loans, auto loans, etc. The information included within the credit account history section contributes most significantly to the calculation of your credit score. For each account, you can expect your credit report to show the following:

- Name of lender

- Date account was opened

- Type of loan

- Date the account was first reported

- Credit limit or original amount of loan

- Status of the account

3. Credit Inquiries

Information about any credit inquiries can be found in a credit report. There are two types of credit inquiries, soft inquiries and hard inquiries.

A hard inquiry occurs when you apply for a new form of credit (such as a loan or credit card), and the person or company you are borrowing from formally requests (or “inquires”) about your credit history.

A soft inquiry generally will not impact your credit score and is typically the result of you looking up your own credit score or a company looking up your score to pre approve you for a particular offer. In these circumstances, your credit score is not being pulled in reference to a specific loan application, and therefore the purpose is strictly informational.

3. Public Records & Collections

The last category of information included in a credit report includes the following:

- Public record information - This information can be found in any state, local or federal books and records. This would include any relevant details on events such as bankruptcy filings or tax liens.

- Collections information - If you do not pay back one of your lenders, they could hire a collections agency to ensure that you pay back your outstanding debt. The information reported by the collections agencies can also be found in your credit report.

How to access your credit report

You can get your credit report for free once every 12 months from each of the three credit reporting agencies: Equifax, Experian, and TransUnion. Due to the COVID-19 pandemic, each of the credit reporting agencies is currently offering free credit reports weekly. Check out annualcreditreport.com for the latest information on the availability of free reports.

anchor

What are the different types of credit?

One of the main factors impacting your credit score is your credit mix. A healthy credit mix is one with a variety of different accounts and types of credit. The different types of credit available can generally be classified as one of the following:

-

Revolving Credit

Revolving credit refers to credit with no real expiration date, such as a credit card. Credit cards allow you to continually borrow money and repay it, up to a specified limit, for as long as you choose or until the account is closed. This is how revolving credit gets its name - it revolves, or stays open, until you choose to close it. This type of credit differs from installment credit in that there is not a specified loan amount and expiration date. Revolving credit is also a great option for building credit history, which is another important factor in the determination of your credit score.

Remember, revolving credit and credit cards are only helpful in building credit if you remember to pay off your credit card on time and in full each month. If paid off timely and in full each month, you will not be charged interest on this type of credit. But, failure to pay outstanding balances off on time and in full can turn revolving credit into bad debt pretty quick!

-

Installment Credit

Contrary to revolving credit, installment credit refers to a fixed amount of money that you borrow and that is paid back over a fixed period of time with interest, such as mortgages, auto loans, student loans or personal loans. While revolving credit remains open until you choose to close it, installment credit opens when you take out the loan, and then closes when the term of the loan ends.

Let’s look at an example. Let’s say you’ve decided to attend college to obtain your undergraduate degree, and will fund a portion of your education with a student loan for $15,000. The term of the loan is 10 years with an interest rate of 4%. The loan starts the day you take out the loan, and closes in 10 years when it is fully paid off. This installment credit has a finite life, and unlike revolving credit, it cannot be consistently drawn on for as long as you like, and it should be paid off in 10 years.

An advantage of installment credit is the generally lower interest rate associated with this type of credit as compared to revolving credit. Mortgages, student loans and auto loans provide the borrower with a fixed term and payment over the life of the loan. This corresponding interest rate is lower, because the borrower is repaying the loan in predetermined installments over the life of the loan.

-

Open Credit

Think of open credit like your monthly utility bill, water bill, or any bill you receive that is based on how much you consume. Each month your electricity provider sends you a bill for a value based on how much electricity you used during that month. This type of credit is called open credit. Open credit differs from revolving credit and installment credit in that it generally doesn’t incur any interest, and the account typically doesn’t show up on your credit report.

If an open credit account appears on your credit report, this could be because your utilities provider reports late payments to the credit bureaus. As with the other types of credit, it’s important to pay off all open credit on time and in full!

anchor

How can you build credit?

A perfect score doesn’t happen overnight. Building credit doesn’t have to be challenging, but it can take some time. We’re not talking about years here, but it can take anywhere from 3 to 9 months to establish credit once you’ve started using credit regularly. Remember, FICO credit scores require 6 months of activity to calculate a score. Here we’ll give you a few tips on building your credit and developing good credit habits.

-

Get a secured card.

Having trouble qualifying for a credit card? You may want to consider a secured credit card. These types of cards are for people who don’t have any credit history, or who have bad credit and want to rebuild it. Before you rush out to get one, there’s a little twist to using this type of credit card: you have to pay a deposit, and that money is your credit limit. So, if you pay a $500 deposit, then your credit limit is $500.

-

Take out a credit-builder loan.

Need to take out a loan, but don’t have a credit history? Consider taking out a credit-builder loan. Credit-builder loans are a good alternative for those with little or no credit. Credit-builder loans are typically offered by small financial institutions. The amount of the loan is held in an account while you make payments on the loan. Once the loan is paid off in its entirety, you can then access the money. As you make payments on the loan, this information is reported by the lender to the credit bureaus, allowing you to build credit while you make these payments.

-

Co-sign with an established borrower.

Co-signing on a loan with an established borrower is another alternative to building credit for those with little to no credit. When co-signing on a loan, both you and the other borrower equally share the responsibility of the loan and the payment history shows up on both credit reports. By sharing the responsibility, you are able to establish credit and prove to lenders through timely payments that you are capable of paying off loans as they come due.

-

Authorized users count, too.

Getting added as an authorized user on someone else’s credit card may help your credit, too. Some, but not all, credit cards will report authorized user activity to the credit bureaus. This method of building credit only works if that person has a good credit history. In short, their card is in your name. If you find someone willing to add you, this is an easy way to take small steps to start your credit history.

-

Pay your balance in full.

You have your first credit card (yay!) but do you keep a balance or pay it off each month? If you can, pay it off in full. This credit pro move shows you can handle the amount you’re spending each month, and that you’re responsible.

-

30% is the magic number.

This is the percentage that is commonly recommended to keep your credit manageable. You should try to keep your credit card balance below 30% of your available credit. This number is known as your credit utilization ratio. (Read more about credit utilization ratios.) This shows your lender that you’re using your credit responsibly and you’re not strapped for cash.

anchor

How can you improve your credit score?

If your credit score is struggling to maintain its A+ status, it’s time to take a look at the debt you have, and assess your current strategy to paying it off. Consider the following questions as part of your self-assessment:

- What debt do I have?

- Am I making monthly payments on all of my debt?

- What are the interest rates on my debt?

- Are there any debt balances with significant interest rates I can pay off now?

If you have small outstanding credit card balances with high interest rates, consider getting those paid off sooner rather than later. Paying off your credit card’s outstanding balance can help reduce your credit utilization. By relying less on the credit you have at your disposal, you reduce your credit utilization percentage (remember, 30% is the magic number) and you demonstrate to lenders that you have a healthy relationship with your credit lines and maintain the ability to pay off your debts as they come due.

Make timely payments.

Once you’ve determined the status of your debt, consider automating your monthly payments. Consistent, timely payments can generally help improve your credit score. Making payments early is even better, because you won’t be late. Lenders calculate your history of on-time and late payments. The more on-time payments you have, the better it reflects on your credit report and credit score. By setting up automated monthly payments on your car loan, credit card bills, and student loans, you’re helping to establish a better payment history, which is one of the largest contributing factors to your credit score.

Check for errors or inaccuracies on your credit report.

If you notice a sudden drop in your credit score and you haven’t recently missed a monthly payment, or applied for a new loan, be sure to review your credit report for inaccuracies. Your credit report could be mistakenly picking up personal information that isn’t yours.

What can you do if you find errors or inaccuracies in your credit report? First, check with your lenders. If the error you’re noticing relates to outdated account information or missing account information, call your lender’s customer support line to check that they are reporting the latest information to the credit bureaus. Generally, your lender can provide some insight as to why there is a discrepancy.

If the error doesn’t relate to your own account information, but you see information on your report that isn’t yours, you can dispute this with the credit bureau. Check the website of the credit bureau where you’re seeing the error - Equifax, TransUnion, Experian - and there you should be able to find guidance specific to that bureau regarding how you can dispute the error. Be sure to gather any supporting documentation for your claim, as you will likely need to share this with the credit bureau.

Consider disputing derogatory items.

Late payments or missed payments can show up as derogatory items on your credit report, which can bring down your credit score. Depending on the type of item, these marks can remain on your credit report anywhere from 7 to 10 years.

If you notice a derogatory mark on your credit report that isn’t accurate and doesn’t agree to the records of payments you have with your lender, you should consider reporting this inaccuracy to the credit bureau to have it removed.

If a derogatory mark is accurate, it’s not quite as easy to have it removed from your credit report. If you don’t want to wait the 7 years it may take for the derogatory mark to fall off of your report, you can call and ask the lender to remove the mark from your history and what is reported to the credit bureaus. Unfortunately, no lender is obligated to do this for you, so there is no guarantee they will remove it. But if you have a history of on-time payments before and after the late or missed payment, you may have better luck making the argument to the lender to remove the mark.

This blog is not intended to provide any tax, legal, financial planning, insurance, accounting, investment, or any other kind of professional advice or services. To make sure that any information or suggestions in this blog fit your particular circumstances, you should consult with an appropriate tax or legal professional before taking action based on any suggestions or information that we provide.