anchor

What is an emergency fund?

An emergency fund is to your personal finances as a life jacket is to a swimmer. A swimmer doesn’t need a life jacket each time they go for a swim, but during an emergency, a life jacket can be a safety net.

An emergency fund is your financial safety net for those expenses that arise during unexpected life events or emergencies, like:

- An unforeseen job loss

- An unexpected medical expense

- A sudden need to relocate due to family member illness

- Property damage from a natural disaster

Often discussed in conjunction with emergency funds are rainy day funds. But how do they differ?

The largest differentiator between expenses covered by your emergency fund and your rainy day fund is the magnitude of the expense. Rainy day funds are used to cover smaller expenses that occur (expected or unexpected during the month) that aren’t part of your typical monthly expenses. These expenses could include car maintenance, parking tickets, or minor home maintenance. Your emergency fund is meant to cover just that, true emergencies.

In this blog post we’ll cover everything you need to know about emergency funds, including:

- Why you need an emergency fund

- How much you should save in an emergency fund

- How to build an emergency fund

- Where you should keep your emergency fund

anchor

Why do you need an emergency fund?

An emergency fund provides you with a safety net during unexpected and stressful times. Losing a job or finding out about an unexpected medical expense is stressful, and not having money that you can rely on during those unexpected circumstances only adds to the stress.

Creating an emergency fund also allows you to avoid taking on additional forms of debt to cover yourself in a time of emergency. Applying for additional loans or opening up a new credit card to pay for unexpected expenses can generally be avoided by establishing an emergency fund.

anchor

How much should you save in an emergency fund?

To determine how much you should have saved in your emergency fund, you’ll need to take a look at your monthly expenses.

Generally, an emergency fund is comprised of about 6 months of your monthly expenses. Six months of monthly expenses saved would allow you, in case of sudden job loss, to continue to pay your bills and buy your groceries without having a source of income for up to 6 months.

To calculate your emergency fund savings goal, break out that calculator and your budget, and add together your monthly payments for the following items:

- Mortgage or rent

- Insurance

- Utilities

- Internet/Cable

- Transportation costs (gas, parking)

- Meals and groceries

- Loan payments (cars, student loans)

- Other recurring monthly expenses

After totalling the amounts above, multiply your total by 6 to arrive at your emergency fund savings goal.

While 6 months of savings in your emergency savings account is generally recommended, if you are more comfortable with an emergency fund savings closer to 9 months or 12 months of your monthly expenditures, go for it. As with all personal finance decisions, this is a personal choice, and each person may choose a different path.

anchor

How do you build an emergency fund?

Now that we’ve covered the importance of an emergency fund and how much you should have saved in it, let’s discuss how to build it.

If you’re reading this thinking, “This emergency fund thing sounds great, but I don’t have hundreds or thousands of dollars to put away in an emergency fund right now,” not to worry. Let’s think about this in a few small steps:

Start Small

Consider starting small by creating an initial savings goal of $500. Take a look at your monthly expenses and see where you may have surplus. If at the beginning of your savings journey you only have $5 or $10 to allocate to your emergency fund each month, that’s a great start.

Automate it

Consider setting up a recurring automatic transfer each month from your checking account to allocate this savings amount to your emergency savings fund. The habit of automating your savings each month allows you to set it and forget it. Over time, you will see the savings build.

Increase your savings goal over time

If you’re starting from scratch, begin with a savings goal of $500. Once you’ve hit this first savings goal, time to think bigger. Set a second goal, and consider looking at other areas in your budget where you may have surplus. Continue this process until you reach your 6, 9, or 12 month savings goal

anchor

Where should you keep an emergency fund?

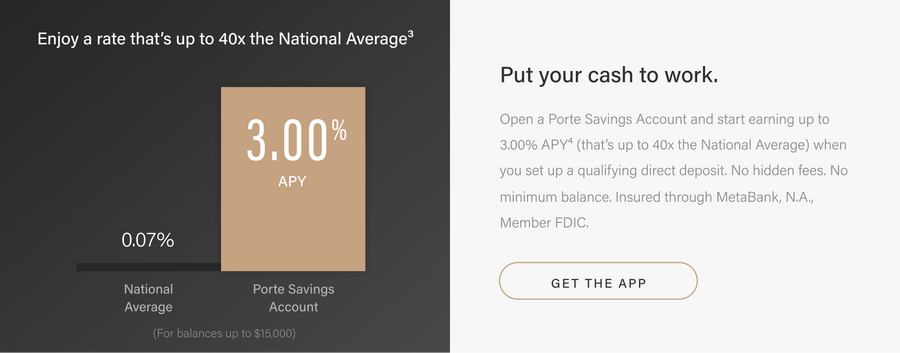

Consider keeping your emergency fund in a high yield savings account. A high yield savings account1 allows you the opportunity to earn interest on your money over time. You’ve worked hard to meet your savings goals. Let your interest work harder for you.

Remember, working towards your emergency fund savings goal doesn’t happen overnight. It likely also doesn’t happen in a week or even a month. Saving towards a goal takes time. But, if you remain diligent, dedicated and patient with your savings goals, you will reap the reward and comfort of knowing you have money saved if you ever need it for an emergency!

This blog is not intended to provide any tax, legal, financial planning, insurance, accounting, investment, or any other kind of professional advice or services. To make sure that any information or suggestions in this blog fit your particular circumstances, you should consult with an appropriate tax or legal professional before taking action based on any suggestions or information that we provide.