Budgeting doesn’t have to be a daunting task. Follow these steps to start creating a personalized budget and setting realistic financial goals.

anchor

Step #1: Set Your “Why”

Are you creating your budget to get out of debt? To stay on track for your long-term financial goals? To break the cycle of living from paycheck to paycheck? Taking the time to set your “Why” will help you stay on track to reach your financial goals.

anchor

Step #2: Set Your Goal

After determining your “Why,” set a clear, specific goal for yourself. The more specific you are the easier it will be to track your progress and determine the steps you need to take to achieve it. For example:

- Build a $1,000 emergency fund within the next 6 months.

- Save for retirement by opening something like a ROTH IRA and contribute $150 per month.

- Pay down a car loan by 50% by the end of the year.

- Pay an additional $250 per month on student loans.

anchor

Step #3: Input Your After-Tax Income into the Budget Calculator

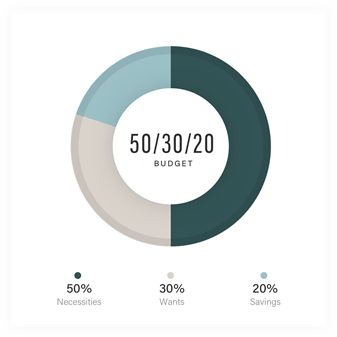

While there are several budgeting strategies to choose from when creating a budget, we have chosen to use the 50/30/20 strategy. This format divides your take-home (after-tax) income into three categories:

- 50% for needs: housing, transportation, food, basic utilities, insurance, minimum loan payments, child care, etc.

- 30% for wants: monthly subscriptions, travel, entertainment, dining out, etc.

- 20% for savings and debt repayment: emergency funds, investments, making larger loan payments, etc.

When you have determined your monthly, after-tax income, input the number into the budget calculator below. This will automatically calculate how much to allocate to each of the categories.

The 50/30/20 budget

A guide for allocating your dollars using the 50/30/20 rule.

Curious to see how much of a difference you’ll make when adding a few bucks to your monthly loan payments? Try Porte’s True Debt Calculator.

anchor

Step #4: Determine How You’re Currently Spending Your Monthly, After-Tax Income

Using your bank and credit card statements, determine how much you are currently spending in each of the 50/30/20 categories. We will use this information in Step #5, as we compare your current spending to the suggested spending of the Budget Calculator.

anchor

Step #5: Create Your Budget

The purpose of this step is to determine how to adjust your current budget to help you achieve your goal from Step #2.

To do this, take the suggested numbers from the Budget Calculator in Step #3 and compare them to the current spending numbers from Step #4.

Are there areas of over or under spending? For areas of overspending, determine if there is a way to decrease spending within that category. For areas of underspending, consider moving these funds into your savings account.

Play around with the numbers until you feel like you have reached a budget that feels doable, and that will help you reach your financial goal.

anchor

Step #6: Use Your Budget and Iterate Over Time

The beginning of each month is typically a good time to evaluate your budget. Answering questions like, “Where’s my budget working?” or “What areas are not working within my budget?” can help you determine the changes you need to make to create the best budget for you.

Do not get discouraged if your initial budget or goals needs to change. Being flexible and adapting your plan to fit your needs will help you feel successful in the pursuit of your financial goals.

Happy budgeting!

This blog is not intended to provide any tax, legal, financial planning, insurance, accounting, investment, or any other kind of professional advice or services. To make sure that any information or suggestions in this blog fit your particular circumstances, you should consult with an appropriate tax or legal professional before taking action based on any suggestions or information that we provide.