Looking for a way to reduce your monthly student loan payments? Refinancing your student loans could be that golden ticket to lower monthly payments.

As with all decisions related to student debt, the choice of whether or not to refinance your student loans will depend on your circumstances. To help guide you in the process, we’ve outlined the who, what, when, and why of refinancing to help you determine if refinancing your student loans could be a good fit for you.

anchor

What is student loan refinancing?

Refinancing student loans is the process of replacing your current student loans with a new loan from a new lender, ideally with a lower interest rate. The old loans are paid off by the new lender, and the new lender provides you with a new, consolidated loan. Let’s look at a simple example.

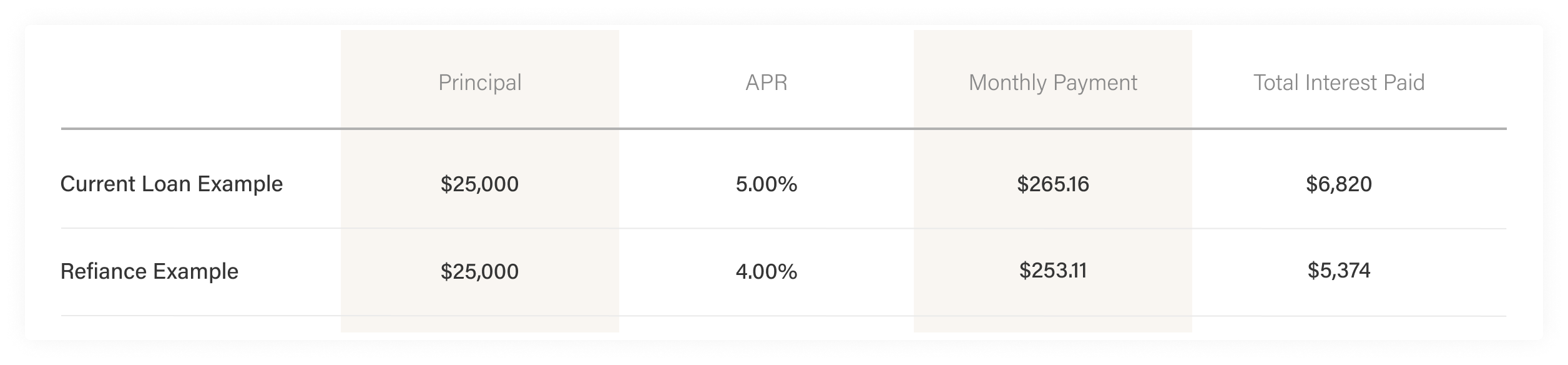

Let’s pretend that you have a student loan with a remaining principal balance of $25,000, a 5% interest rate, and a remaining term of 10 years. In this example, your current monthly payment would come to about $265/month. You decide to refinance the loan with a new loan provider at an interest rate of 4% and a remaining term of 10 years. Once the refinancing is complete, meaning the new lender has paid off the loan of the old lender and issued you a new loan, your new monthly payment would be about $253/month. By refinancing in this example you could save approximately $12/month, and over the 10 year term, you could save a total of approximately $1,500.

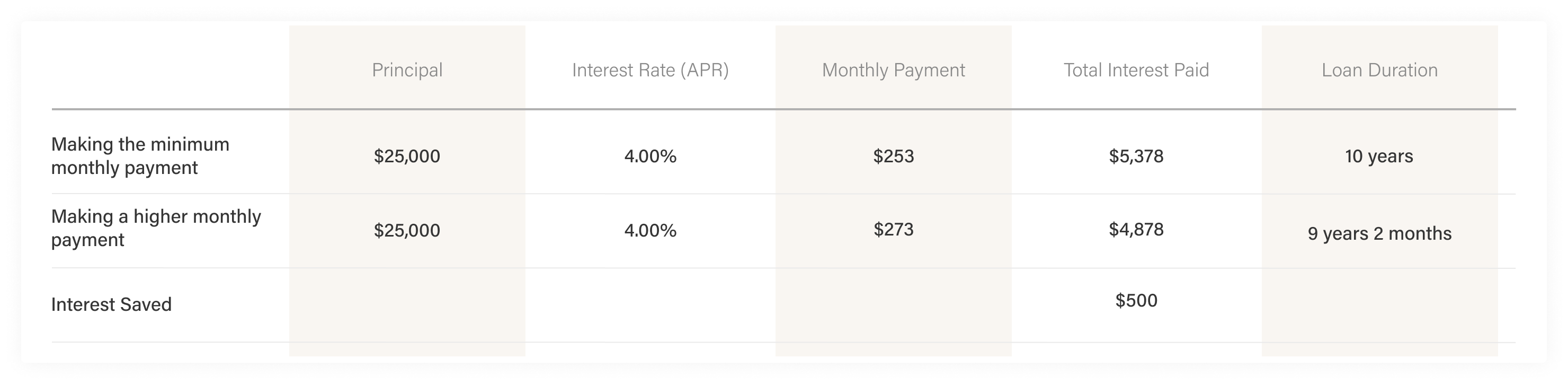

If you don’t have a need extra saved through lower monthly payments, consider applying the extra toward principal to save even more money.

In this example, by applying an additional $20.00 towards the principal each month you could save close to $500 over the life of the loan and pay off your student loan 10 months early.

anchor

Why refinance your student loans?

Simply put, refinancing your student loans can save you money. In our example above, you can see that by lowering the interest rate by 1% you could save a potentially significant amount of money in interest over time.

Seems easy enough. But, is there ever a reason why you may not want to refinance your student loans? Yes, and it’s important to understand both sides of the coin on this matter. Take a look at the benefits you have with your current student loans. Depending on the type of student loan you have, you may have certain loan forgiveness or deferment benefits that you may have to give up if you decide to refinance. So while refinancing for a better interest rate is great, it’s important to know what you’re giving up in order to get that better rate.

anchor

Who can refinance their student loans?

Individuals with private or federal student loans can refinance. The qualifications for refinancing student loans differ depending on the loan provider but have similar qualifications to those you may see when applying for a private student loan. Generally, a good credit score and evidence of a stable income are common requirements needed in order to refinance. If you don’t have either of the previously mentioned items, you may be able to apply with a co-signer. It’s important to review the qualifications of all potential lenders to ensure you meet the requirements before you apply for refinancing.

While individuals with federal student loans are allowed to refinance, it’s important to recognize which of your federal student loan benefits you will be foregoing should you choose to refinance with a private student loan provider. Various benefits, such as loan forgiveness, deferment, forbearance, or income driven repayment plans are often only offered under federal student loan programs and are not as likely to be offered as part of your refinancing. It’s important to consider these factors in your decision to refinance. While a low interest rate may be enticing, other benefits under your current loan could be of greater importance to you.

anchor

When can you refinance student loans?

Student loans can be refinanced at any time and as often as you want. There are no fees or costs associated with refinancing your student loans or applying to refinance.

While it’s possible to refinance your student loans as often as you want, it is important to consider the potential impact frequent refinancing could have on your credit score. When you’ve determined which lender you want to refinance with and you submit your full application, the lender will generally perform a hard credit check at that time. Frequent, hard credit inquiries in a short period of time can have a negative impact on your credit score.

Generally, professionals are more likely to refinance their student loans than students who are still working on their degree. While lenders may still allow students to refinance, it’s important to check the eligibility requirements of any potential lenders as graduation may be a requirement to apply for refinancing.

Consider refinancing your student loans if you can reduce your monthly payment, interest rate, or total interest paid over the life of the loan.

anchor

How do you refinance student loans?

To start the refinancing process, begin by gathering all the important information (for both you and your co-signer, if applicable) that you need to complete the application process. Generally, in addition to your current student loan contract, you’ll need the following personal information:

- social security numbers

- addresses

- birthdate

- employment and income information (pay stub copies)

- most recent tax returns

- any mortgage or asset details.

If you’re still in school, you may also need some information about your school:

- the school’s name

- address of the school

- how much you will need to take out in a new loan

- when you expect to graduate

Next, you’ll want to start researching the different loan provider options for refinancing. Some student loan refinancing lenders include Earnest, Education Loan Finance, Discover, SoFi, and Splash Financial. Consider making a list with the following column headers:

- Loan provider name

- Qualification requirements

- Interest rate

- Term

- Monthly payment

- Additional benefits

Including your current loan information at the very top of this list will allow you to easily see with one glance how your potential new loans stack up against your current loan.

Remember, while refinancing your student loans is a great option to reduce your monthly payments, it might not be the perfect solution for everyone. Consider your personal needs and the benefits that are important to you prior to making any big refinancing decisions.

This blog is not intended to provide any tax, legal, financial planning, insurance, accounting, investment, or any other kind of professional advice or services. To make sure that any information or suggestions in this blog fit your particular circumstances, you should consult with an appropriate tax or legal professional before taking action based on any suggestions or information that we provide.