The referral link you used is no longer valid. You can try another referral link or download Porte in the App Store or Google Play.

Porte is a full-service mobile banking app

Porte is a mobile finance app, not a bank. Banking services provided by Pathward, National Association, Member FDIC.

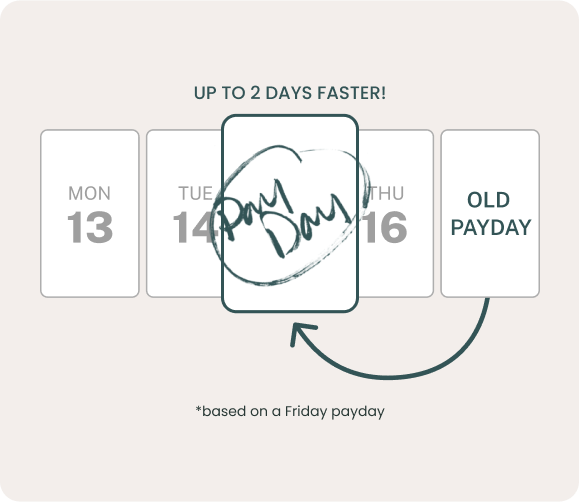

Get paid early

Get paid up to 2 days faster1

with Direct Deposit

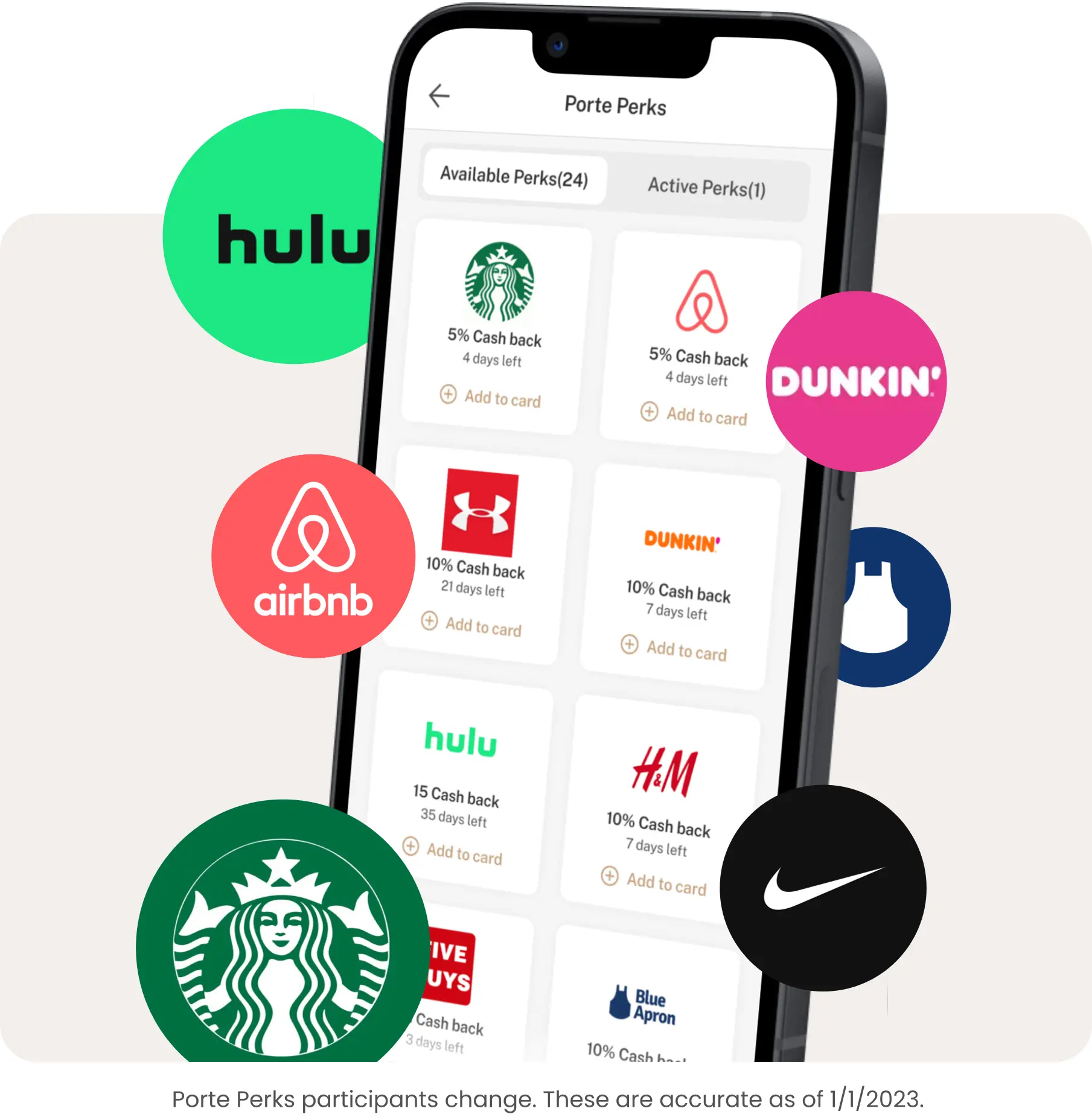

Porte Perks

Earn up to 10% cash back rewards with your Porte Visa debit card3

Porte Perks participants change periodically. Check your Porte app for current participants.

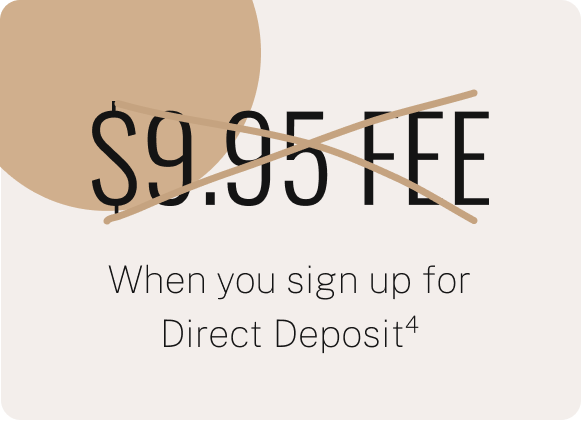

Set up qualifying Direct Deposit to skip these fees

Set up qualifying Direct Deposit to skip these fees

With Qualifying Direct Deposit

Without Qualifying Direct Deposit

No surprise fees!

ATMS

40,000+ fee-free MoneyPass® ATMs8

Optional Overdraft Service

Overdraft Service when you need it10

FAQs

What is Porte?

Porte® is a mobile banking app with the service you love. We designed Porte with the idea that banking has a purpose, and transparency in banking is our primary focus. Porte works with Pathward®, National Association, to bring you a premium mobile banking experience that provides the access, products, and features you need.

The name Porte comes from the French word for “door.” Porte is an open doorway to banking that gives back. At Porte, we listen to our customers as well as learn and evolve with them to secure their future. Porte brings modern mobile banking together with the in-person service you need. Visit the About page to learn more.

Porte is a mobile finance app, not a bank. Banking services provided by Pathward®, National Association, Member FDIC.

How do I sign up for a Porte account?

Sign up is simple, and opening an account11 takes just a few minutes. Download the Porte app from the App Store® or Google Play™ app stores and follow the steps. You can also visit any ACE Cash Express location and a friendly associate will assist you in getting started.

Why is Porte available at ACE Cash Express stores?

Porte is committed to listening to our customers’ needs, and we know that having access to in-person service at retail locations is a huge part of creating a valuable experience. With a consistently high star rating average on Google from over 250,000 reviews across the country, ACE Cash Express stores provide top service!

Is the Porte banking app safe?

Porte takes security seriously. We offer push notifications through the mobile banking app to help you stay on top of transaction activity, virtual cards to shop in a more secure way online, and Card Lock to quickly block your debit card from use if it goes missing. Plus, all funds are FDIC-insured through Pathward, N.A. For purposes of FDIC coverage, all funds held on deposit by you at Pathward, N.A., Member FDIC. will be aggregated up to the coverage limit, currently $250,000.

Porte is a mobile finance app, not a bank. Banking services provided by Pathward®, National Association, Member FDIC.